If you are concerned about Gold IRA risks and the reputation of the Gold IRA company you are considering and have fears of your gold being lost because of malfeasance or negligence you need to conduct a background check of the company you are considering. Your due diligence should be the same with researching a Gold IRA company as you would with any company you are conducting a high value transaction. A Gold IRA company’s credibility and trustworthiness is made up of many different factors. How long have they been in business? What is their reputation in the industry. Do they have problems fulfilling promises to their customers?

If you search online, you will find that many of the answers to these questions and more can be found. You can do a simple search on any search engine or the BBB and find infractions and mistakes made by any company. Most companies in business for some time will make mistakes. Take your findings and concerns to the Gold IRA company’s representative that you are working with, give them an opportunity to address these issues.

If you are talking about other risks with having a Gold IRA, then yes, gold can go down in price and value. However, a Gold IRA is only something that should be considered as long term investment and to insure your wealth from unexpected events in the world. A Gold IRA is something that is like insurance when those negative events happen.

To make sure that your gold is safe, it must be stored separately from the company that you bought it from. Companies that store gold for you are called Gold Custodians. More information on ‘gold custodians’ can be found here….

You may also receive more information and a special offer from our selected gold IRA company here….

Simply stated, no. At the age of 59 1/2, you will be able to take physical possession of your metals, through distributions, without any penalties. Until that time the gold in your Gold IRA account will be in the hands of an Gold IRA custodian and held in your name just like any other IRA account. This is an IRS requirement.

Find out more about your IRA Gold Account storage options with our selected IRA Gold Company’s Free Report here…

Yes, while gold and silver are the most popular precious metals held in Gold IRAs, the IRS allows for some platinum and palladium products to also be included in your IRA.

You can find more information on the coins and bars that are eligible in our list here..

Our preferred Gold IRA company provides a free Gold IRA kit and a list of eligible coins and bullion here…

The IRS requires that any IRA have a custodian. It is no different with a Gold IRA Account. As with any investment do your due dilegence and check out the Gold IRA company you are considering.

Each Gold IRA Account’s assets should be overseen by a Gold IRA Custodian. Ask your Gold IRA company if their recommended Gold Custodian and depository are IRS approved.

You can learn more about ‘gold custodians’ here…

Our selected Gold IRA Company uses credible and qualified IRS-approved gold custodians and depositories. Get their Gold IRA kit here today….

This is called a rollover. It usually is made up of three parts.

First you must choose a reputable and qualified Gold IRA company, there you work with an IRA specialist to assist you in opening your gold IRA account.

Next, you will fund your new gold IRA account from your old existing IRA account. There is no penalty for this transfer.

Finally, once your gold IRA is funded, your gold IRA company will provide you with a choice of eligible precious metals products to select from that will meet your IRA investment goals.

Our preferred precious metals IRA company can guide you through this process and offers an IRA Investment kit here….

Once you have chosen your Gold IRA Company and have opened an account, your gold account specialist will help you transfer funds from your old IRA account. No other personal or funds outside your IRA will be needed.

Our selected Gold IRA company can guide you through this process and offers a FREE Gold IRA guide here….

First you must choose a reputable and qualified Gold IRA company, there you will work with an gold IRA specialist to open your gold IRA account.

Once you have opened an account, you will fund your new gold IRA account from your old existing IRA account. There are no IRS penalties to perform this transfer.

Once your gold IRA account is funded, your gold IRA specialist will offer you a choice of eligible precious metals products to select from that will meet your IRA investment goals.

Our chosen Gold IRA specialists can help you through this process and offer an IRA Gold guide to show you how i’s done from start to finish here..

To make sure that your gold is safe, it must be stored separately from the company that you bought it from. Companies that store gold for you are called Gold Custodians.

Your Gold IRA account will be in the hands of an IRA custodian and held in your name just like any other IRA account. This is an IRS requirement. The IRS requires that any IRA have a custodian. It is no different with a Gold IRA Account. As with any investment do your due dilegence and check out the Gold IRA company you are considering.

Ask your Gold IRA company if their recommended Gold Custodian and depository are IRS approved.

Our preferred Gold IRA specialists can answers any questions you may have regarding security as it applies to their Gold IRA account services and storage. They have a concise Gold IRA Guide available at no cost here…

More information on ‘gold custodians’ can be found here….

A gold IRA works in much the same way as most IRAs, except you are investing in hard assets within your self directed gold IRA account. A self directed IRA allows you to invest in alternative investments as defined by the IRS which includes gold, silver and other precious metals.

The administration of the gold IRA’s physical assets are performed by an IRS approved custodian that you assign and your metals are stored in an IRS approved valt or depository.

You may open gold IRA account if you are under 70 1/2 years old and have earned income. You may start taking distributions at age 59 1/2. Taxes on withdrawls depend on your age and income at the time of withdrawl.

Taxes on gains in your gold IRA investment is deferred until withdrawl. You may start taking distributions at age 59 1/2. Taxes on your gold IRA distributions depend on your age and income at the time of withdrawl.

Your individual tax implications will vary. Speak to one of our preferred gold IRA specialists to find out more about how gold is taxed in a self directed Gold IRA account.

Get your Free Gold IRA Guidebook here…

Setting up a Gold IRA account can take as little as two weeks and will take as long as you delay finishing all the steps to create your Gold IRA account.

There are only three steps to getting your Gold IRA account up and running:

1. You first choose a reputable and qualified Gold IRA company, there you will work with a gold IRA specialist to open your gold IRA account.

2. After you have opened an account, you will fund your new gold IRA account from your old existing IRA account. There are no IRS penalties to perform this transfer.

3. When your gold IRA account is funded, your gold IRA specialist will offer you a choice of eligible precious metals products to select from that will meet your IRA investment goals.

Our chosen Gold IRA specialists can help you through this process and offer an IRA Gold guide to show you how it’s done from start to finish here..

The amount of money you initially use to fund your Gold IRA account can vary. It depends on the balance of your old IRA account you plan to roll over, your age and your retirement investment goals. Also, some IRA gold companies may have investment minimums calculated to give you the best chance of lowering your initial Gold IRA fees while maximizing the amount of gold you can initially place in your new Gold IRA.

Ask your Gold IRA specialist what their minimum investment is and what fees and premiums are involved.

Our selected Gold IRA specialist can answers this question thouroughly and guide you through the entire Gold IRA account process. They also have a comprehensive Gold IRA guide they would like to send to you today, you can find it here…

No. You may start taking distributions at age 59 1/2. Taxes on withdrawls depend on your age and income at the time of withdrawl.

You may ask a specialist at our preferred Gold IRA company this question in greater depth to help you decide if a Gold IRA is a good idea for your retirement plans. They also offer a concise Gold IRA Planning Guide at no cost here…

There are too many benefits to opening a gold IRA account to attempt to fully list here.

First, depending on when you start making investments in gold for retirement, time will be on your side. You should plan to open a Gold IRA account at least five years before retiring to take full advantage of time as you continue adding to your Gold IRA with several contributions before retiring, it’s value could grow exponentially and become an important part of any investment strategy, especially if inflation rises or markets decline (including major world events).

Gold has always been a respected store of wealth and still is. Many recent trends show that with all other types investing being unpredictable due to instability around the globe and with potential bubbles; this is one asset class where it’s stability reigns supreme.

Our selected Gold IRA Specialists can show you many more benefits to investing in an IRA Gold Account. Order your free IRA Gold Guide here today!

There are many benefits to opening a gold IRA account. First, depending on your age when you start making investments in gold for retirement, time will be on your side. If you plan to retire more than five years from now and continue adding to your Gold IRA with several contributions before retiring, it will grow exponentially and become an important part of any investment strategy if inflation rises or markets decline (including major world events).

Gold may not always have been considered a wise way to invest but has always been a respected store of wealth and still is. Many recent trends show that with all other types investing being unpredictable due to instability around the globe; this is one asset class where it’s stability reigns supreme.

Our selected Gold IRA Specialists can show you many more benefits to investing in an IRA Gold Account. Order you free IRA Gold Guide here today!

There are a handful of fees to set up and maintain a Gold IRA Account.

First, there is a fee to process your new self directed gold IRA application. This is typically a one time fee charged by your chosen Gold IRA Company and usually less than $150.

Next, when you purchase your precious metals coins or bars, there maybe be the following:

A transaction fee. This fee is placed on every transaction you conduct with your Gold IRA Account and will be listed in your Gold IRA Company’s schedule of fees. There may be a markup on top of the price of your purchase. this is also known as a ‘premium’ and is dependant on the type of coins or bars you buy and their current popularity and demand in the marketplace. Ask your Gold IRA specialist for a breakdown of these costs as they will vary from company to company.

Once you have set up and funded your Gold IRA and purchased your precious metals and have had your them placed in an IRS approved storage facility, future annual maintenance will be simple and economical.

Plan on paying a yearly adminitrative and storage fees of between $200 and $300. Be sure to ask you Gold IRA specialists for a disclosure on these annual fees.

Our preferred Gold IRA company can answer this question and provide you with the appropriate disclosures. Get your no cost IRA Gold Guide here…

Once you have set up and funded your Gold IRA and purchased your precious metals and have had your them placed in an IRS approved storage facility, future annual maintenance will be simple and economical.

Plan on paying a yearly storage fee of between $200 and $300. Be sure to ask you Gold IRA specialists for a disclosure on these annual maintenance and administration fees.

Our preferred Gold IRA company can answer this question and provide you with the appropriate disclosures. Get you no cost IRA Gold Guide here…

If you are talking about the financial risks of investing in gold in your self directed Gold IRA, then yes, gold can go down in price and value. However, a Gold IRA should only be considered as long term investment and to insure your wealth from unexpected events in the world and inflation. A Gold IRA is something that is like insurance to protect your wealth when unexpected negative events take place.

If you are concerned about Gold IRA risks and the reputation of the Gold IRA company you are considering and have fears of your gold being lost because of malfeasance or negligence you need to conduct a background check of the company you are considering. Your due diligence should be the same researching a Gold IRA company as you would with any company you are conducting a high value transaction with. A Gold IRA company’s credibility and trustworthiness is made up of many different factors. How long have they been in business? What is their reputation in the industry. Do they have problems fulfilling promises to their customers?

If you search online, you will find that many of the answers to these questions and more can easily be found. You can do a simple search on any search engine or the BBB and find infractions and mistakes made by any company. Most companies in business for some time have made mistakes. Take your findings and concerns to the Gold IRA company’s representative that you are working with, give them an opportunity to address any issues you have found.

Also note that to make sure that your gold is safe, it must be stored separately from the company that you bought it from, this is an IRS requirement. Companies that store gold for you are called Gold Custodians. More information on ‘gold custodians’ can be found here….

You may also receive more information and a special IRA Gold Investment Guide from our selected gold IRA company here….

Taxes on the gains on your gold investment are deferred until withdrawl.

You may start taking distributions at age 59 1/2. The potential tax implications of your gold IRA distributions depend on your age and income at the time of withdrawl.

Our preferred Gold IRA company can help you create a distribution plan that help create the most efficient ROI on your funded Gold IRA account. Get their no-cost Guide To Gold IRAs here….

Speak to your Gold IRA Specialists for guidance on your specific IRA contribution limits. They can provide clearer context and guidance on this issue.

Speak to our preferred Gold IRA specialist today and recieve your no cost Gold IRA Guidebook here…

Just like with any IRA account, if you withdraw money or metals from your Gold IRA before age 59 1/2, you may be required to pay an early withdrawal penalty unless the withdrawl is qualified for an exemption.

Early withdrawls can cost you money , so be sure you understand what the penalty amounts would be. Your IRA Gold Company specialist can detail the penalties and exceptions for early withdrawl.

Get your no cost IRA Gold Guide today here…

To comply with IRS requirements, all IRAs, including Gold and precious metals IRAs, must be in the possession of an IRS approved trustee or custodian and cannot be in the IRA owner’s individual possession. Home storage is not allowed.

As per IRS Publication 590 which specifies that for all IRAs, “The trustee or custodian must be a bank, a federally insured credit union, a savings and loan association, or an entity approved by the IRS to act as trustee or custodian.”

Ask your IRA Gold Specialist which gold custodian and storage facility they recommend and whether or not they are approved by the IRS?

You can learn more about Gold IRA requirements in our selected IRA Gold Campany’s Free IRA Gold Kit and Guide here…

A gold IRA is a self-directed investment account that allows you to make contributions of precious metals such as gold and silver coins and bullion into an individual retirement account (IRA). Your assets will be professionally administered by custodians who are well versed on how best manage precious metals transactions involving these types of investments. Once you have your Gold IRA set up, there should be very little maintenance other than setting up automatic contributions which can then automatically draw from funds based on preset parameters if desired.

Our selected IRA Gold Company specialists can answer any questions you have regarding IRA Gold accounts. They even have an IRA Gold Guide they would like to send to you today. It can be ordered at no cost here….

To comply with IRS requirements, all IRAs, including Gold and precious metals IRAs, must be in the possession of an IRS approved trustee or custodian and cannot be in the IRA owner’s individual possession. Home storage is not allowed.

As per IRS Publication 590 which specifies that for all IRAs, “The trustee or custodian must be a bank, a federally insured credit union, a savings and loan association, or an entity approved by the IRS to act as trustee or custodian.”

Once you have set up and funded your Gold IRA and purchased your precious metals and have had them placed in an IRS approved storage facility, there will be annual maintenance and administrative fees paid to your gold IRA custodian and gold storage vault .

Plan on paying a yearly storage fee of between $200 and $300. Be sure to ask your Gold IRA specialist for a disclosure on these annual maintenance and administration fees.

Learn how our selected Gold IRA company can help you set up your own self directed Gold IRA quickly and economically. Get your Gold IRA Guide here…

The IRS code specifies certain gold, silver, and platinum coins that qualify as IRA-eligible or IRA-Approved.

The minimum purity standards for these items are determined by the type of metal they’re made from. For example: Gold bars must be at least .995% pure or higher; Silver bullion (rounds) should have a fineness no less than .999%; Platinum is to be 99%+; Palladium has an upper limit of 98%.

Collectibles can not be included in your retirement fund in any way shape or form – so any collectible form of precious metals like collectible coins aor jewelry are not allowed either.

Our selected Gold IRA Company will answer any questions you may have about what are IRA elegible precious metals for your account. Order your IRA Gold Guide today to see what coins and bars are available. You can order your free guide here today!

The IRS code specifies certain gold, silver, and platinum coins that qualify as IRA-eligible. The minimum purity standards for these items are determined by the type of metal they’re made from. For example: Gold bars must be at least .995% pure or higher; Silver bullion (rounds) should have a fineness no less than .999%; Platinum is to be 99%+; Palladium has an upper limit of 98%.

Collectibles such as stamps and art can not be included in your retirement fund in any way shape or form – so other forms of precious metals like collectible coins and jewelry aren’t allowed either.

Our selected Gold IRA Company will answer any questions you may have about what are IRA elegible precious metals for your account. Order your IRA Gold Guide today to see what coins and bars are available. You can order your free guide here today!

Deciding on how much you want to initially invest in your Gold IRA account should be based on your retirement investment goals such as how long is it until your retirement, what your other retirement accounts have in them and your aversion to any investment risks. It also depends on the balance of your old IRA account you plan to roll over.

Also, most IRA gold companies have gold IRA investment minimums calculated to give you the best chance of lowering your initial Gold IRA fees while maximizing the amount of gold you can initially place in your new Gold IRA.

Ask your Gold IRA specialist what their Gold IRA minimum investment is and the accompanying schedule of fees.

Our preferred Gold IRA specialist will answers this question thouroughly and guide you through the entire Gold IRA account process. They also have a comprehensive Gold IRA guide they would like to send to you today, you can find it here…

Gold bullion products are held to the minimum purity requirement for IRA gold, which is set at .995% pure or fine. In other words, a gold coin or bar must be at least 0.995% pure and it should also have a fineness of not less than 95%. This list of ira eligible gold coins are determined to be IRS approved for your self directed IRA investments:

The American Gold Eagle has been minted by the US Mint since 1986. It is one of the world’s most popular coins and considered to be among the best in terms of gold quality, purity, and weight. The series was designed by Miley Busiek under President Ronald Reagan as part of an effort to create more interest in gold coins. The coins are made of .9167 gold and come in four different sizes: 1 oz, ½ oz, ¼ oz, and 1/10th ounce. The American Gold Eagle features a rendition of Lady Liberty on the front with an eagle on the back.

Eagles are highly sought after because they have been minted exclusively to create more interest in gold coins, which had lost popularity during 1980s due to high inflation rates. As such, the coins have been minted in smaller quantities than other US gold coin denominations.

Collectors have dubbed these 22 karat standard coins as “America’s Most Beautiful Gold Coin.”

The American Gold Eagle is ‘IRA Eligible’ meaning that it meets the IRS’s requirements to be included in a retirement account. At .9167 pure it would not normally meet meet the IRS purity standard for gold coins which is .9999 fine. However an exception was made. We are happy to add these beautiful coins to our list of IRA eligible gold coins.

American Gold Eagle Proof Coins have been minted since 1986, are IRA eligible and are approved by the IRS for self directed IRAs. They share the same design with the standard coins created by Miley Busiek with a rendition of Lady Liberty on the front with an eagle on the back. These legal tender 22 karat gold coins are made from .9167 fine gold with weights of one ounce, one-half ounce, one-quarter ounce, and one-tenth ounce sizes ounce, just like regular bullion coins.

American Eagle Gold Proof Coins have a limited mintage, are struck at the US Mint at West Point and bear the “W” mint mark.

Why are these coins IRA eligible? – Because these proof grade American Gold Eagle coins have been minted by the Treasury Department and have legal tender status in the United States. They are made from .9167 fine gold which would not normally meet the IRS purity standard for gold coins which is .9999 fine. However an exception was made for these beautiful coins.

Britannia Gold Bullion Coins are bullion coins, issued in gold since 1987, by the Royal Mint in the United Kingdom. The original designer was Philip Nathan, the current coin features a standing figure of the Lady Britannia, holding both trident and shield with a bust of Queen Elizabeth II on the obverse.

In 2013 the fineness of the gold in the Britannia Gold Bullion Coin rose to .9999 pure or 24 karat gold which made them eligible for inclusion in our list of ira eligible gold coins as investments in self directed precious metals IRAs in the United States.

Gold Britannias also are issued in fractional sizes of one-half, one-quarter, and one-tenth of a troy ounce and with face values of £50, £25, and £10 respectively. In 2013 two additional sizes were introduced, a five-ounce coin of face value £500, and a fractional size of one-twentieth of face value £5.

The Queen’s Beasts Gold Bullion Coins minted by the United Kingdom’s Royal Mint are a series of 24 karat gold coins each carrying the depiction of one of ten heraldic beasts associate with a badge or arms of a family from the ancestry of Queen Elizabeth II.

Engraver Jody Clark designed the entire series after the ten heraldic statues representing the genealogy of Queen Elizabeth II, depicted as the Royal supporters of England which stood in front of the temporary western annexe to Westminster Abbey during the Queen’s coronation in 1953. The statues were placed left to right in the following order when facing the annex from the west: The Lion of England, the greyhound, the yale, the dragon, the horse, the lion of Mortimer, the unicorn, the griffin, the bull, and the falcon.

The Queen’s Beasts series of ten coin designs from The Royal Mint, inspired by the ancestral beasts of heraldry, myth and legend was launched in 2016 and released in 1 ounce (face vale of £100) and 1/4 ounce (face value of £25) weights in .9999 fine gold as follows:

1st– The Lion of England – 2016

2nd– The Griffin of Edward III – 2017

3rd– The Red Dragon of Wales – 2017

4th– The Unicorn of Scotland – 2018

5th– The Black Bull of Clarence – 2018

6th– The Falcon of the Plantagenets – 2019

7th- The Yale of Beaufort – 2019

8th- The White Lion of Mortimer – 2020

9th- The White Horse of Hanover – 2020

10th-The White Greyhound of Richmond – 2021

The weight and .9999 gold purity makes them eligible for inclusion as an investment in self directed IRAs in the United States.

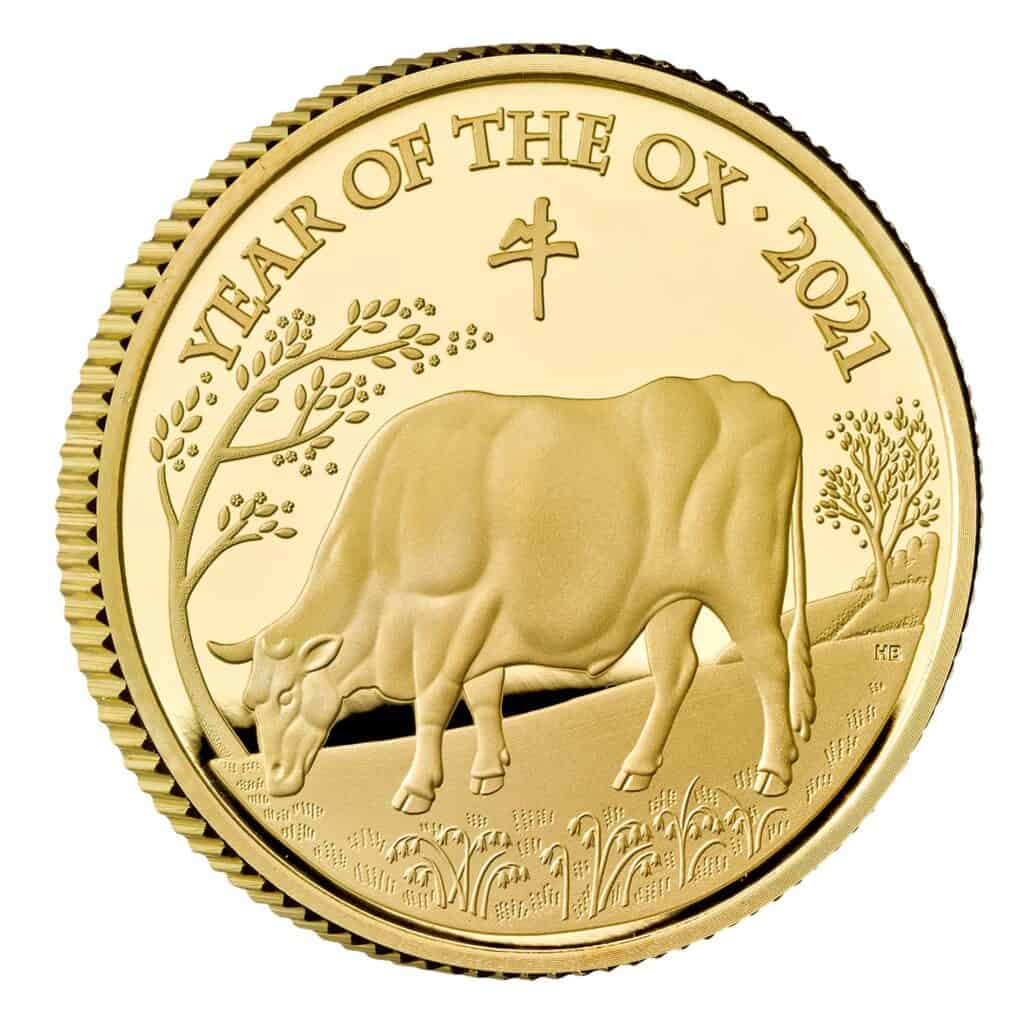

The Royal Mint’s Lunar or Shēngxiào (生肖) coin series is a collection of British coins issued by the Royal Mint featuring the Chinese zodiac in celebration of Chinese New Year. First issued in 2014, the series has been minted in varying denominations of Silver and Gold as both bullion and proof.

To date 8 out of the planned 12 coin Royal Mint Shēngxiào Lunar Series have been issued. The United Kingdom’s Royal Mint first launched the Shēngxiào Lunar Gold Coin Series in 2014. In commemoration of Chinese new year, each coin feature one of the 12 animals from the Chinese Zodiac. Mintage numbers of the 1 ounce gold coins are very limited and always include the auspicious number eight (8) which is a lucky number in Chinese culture.

These 1 ounce legal tender coins are minted in .9999 fine gold with issuance in the following order since 2014:

2014 – Year of the Horse

2015 – Year of the Sheep

2016 – Year of the Monkey

2017 – Year of the Rooster

2018 – Year of the Dog

2019 – Year of the Pig

2020 – Year of the Rat

2021 – Year of the Ox

It seems clear that this series will continue with the yearly additions of the Tiger, Rabbit, Dragon and Snake to the line up.

The purity of these coins make them eligible for Self Directed IRAs in the United States.

The Canadian Gold Maple Leaf struck by the Royal Canadian Mint is a gold bullion coin struck in several weights and denominations and minted annually by the Government of Canada. The first year of issue, 1979, Gold Maple Leafs were minted in .999 pure gold. Subsequent years they have been minted in .9999 fine gold and .99999 (Five Nines) in special issue mintings.

It has been issued every year since 1979 and from 2014 it has been made available in a number of weights including 1 oz., 1⁄2 oz., 1⁄4 oz., 1⁄10 oz., 1⁄20 oz. and 1 gram.

Each legal tender coin, aside from some special issues, feature the profile of Queen Elizabeth II of Canada and the Canadian Maple Leaf on the obverse and reverse, respectively.

Unique security features were added in 2013 and 2015. In 2013, a laser-micro-engraved textured maple leaf was added on a small area of the Maple Leaf side of the coin. In the center of the tiny maple leaf is a number denoting the coin’s year of issue, which is only visible under magnification. In 2015, the coin’s background, radial lines, were added on both sides of the coin.

As one of the purest official bullion coins worldwide at .9999 fine, it is eligible as an investment for Self directed gold IRAs in the US.

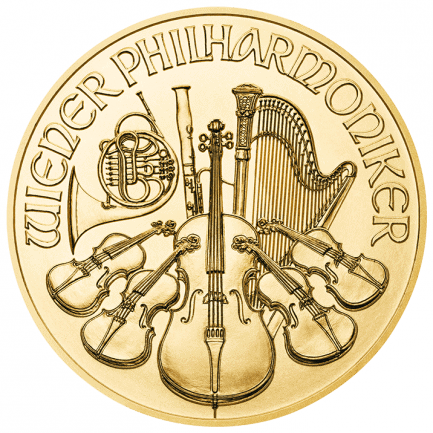

The Austrian Mint’s Gold Philharmonic Coin was introduced in 1989 as a one-troy ounce gold coin with a face value of 2,000 Austrian schillings. Regularly shortened to ‘Philharmonic’ this pure gold coin boasts a fineness of 999.9 (often written 0.9999, also known as 24 karat or 99.99% pure.

The design on the coin remains the same each year; only the year of issue changes. Designed by the chief engraver of the Austrian Mint, Thomas Pesendorfer the Philharmonic was initially minted in two sizes: one-ounce and one-quarter ounce. The one-tenth and one-half ounce coins were added in 1991 and 1994 respectively.

The Philharmonic’s fineness of 999.9 makes it eligible to add to this list of ira eligible gold coins as investments in self directed gold IRAs in the United States.

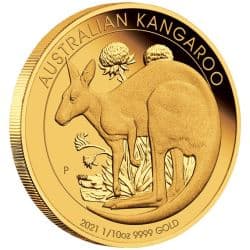

The Perth Mint’s Australian Gold Nugget is a 24 Karat gold bullion coin available in 1⁄20 oz, 1⁄10 oz, 1⁄4 oz, 1⁄2 oz, 1 oz, 2 oz, 10 oz, and 1 kg of 24 Karat gold. The Australian Gold Nugget was launched in 1986 by Gold Corporation, a company wholly owned by the Government of Western Australia. It is better known by it’s trade name, the Perth Mint.

From 1986 to 1989, the reverse of these coins pictured various Australian gold nuggets. With the 1989 proof edition, the design was changed to feature different kangaroos on the reverse, a more world-recognised symbol of Australia. The coins are today sometimes referred to as “gold kangaroos”. Current yearly releases feature the portrature of Queen Elizabeth II on the obverse, designed by Jody Clark, as well as the coin’s monetary denomination.

A purity of .9999 fine makes the Gold Nugget eligible in our list of ira eligible gold coins as an investment in self directed gold IRAs in the United States.

The American $50 Buffalo Gold Coin is the first 24-karat gold coin ever minted by the United States Mint. Its obverse design is based on James Earle Fraser’s 1913 original Indian Head Nickel design. The Gold Buffalo has not changed it’s design since launching in 2006. The reverse side design features a bison standing on one leg, while it grazes near a pond or river.

Like all United States Gold Bullion Coins, the American Buffalo gold pieces are being struck at the West Point Mint in New York.

Gold Bufflo Coins struck in 2006 and 2007 coins were only issued in the one-ounce version, however in 2008, $5, $10, and $25 face value coins were minted with 1/10 oz, 1/4 oz, and 1/2 oz of pure gold respectively.

Admist the financial crisis of 2008, a temporary sales halt was announced because the US Mint couldn’t keep up with demand and due to a shortage of gold from investors seeking the safety of gold causing a spike in gold prices.

Because these American $50 Gold Buffalo coins have been minted by the Treasury Department and have legal tender status in the United States are made from .9999 fine gold, they meet the IRS purity standard for gold coins which is .995 and as such are considered IRA eligible gold coins.

Gold bars may also be included in a self directed gold IRA account when the gold bars and rounds are produced by a NYMEX or COMEX-approved refinery or national government mint, meeting minimum fineness requirements.

The right time to consider or start any retirement investment strategy is when it is top of mind.

Time is the greatest denominator in determing if a retirement investment will pay off. The more time an investment has to mature the more compounding that can occur. Pair long term commitement and contributions with compounding and tax deferment and you have a recipe for success for anyone.

Contact our preferred IRA Gold Company to have them show you how you can successfully grow your retirement nest egg with precious metals.

Order your no cost Gold IRA Kit here today!

Once your Gold IRA account is funded and you have purchased the precious metals you have chosen for your account, your Gold IRA company will have your metals securely transfered to a IRS approved depository or vault. There your metals will be secured and under the administration of an IRS approved gold custodian.

Ask your Gold IRA company if their recommended Gold Custodian and depository are IRS approved.

Our preferred Gold IRA company specialists can answers any questions you may have regarding security as it applies to how and where your gold is stored . They have a concise Gold IRA Guide available at no cost here…

Once your you have purchased the precious metals you have chosen for your Gold IRA account, your Gold IRA specialist will have your precious metals transfered securely to a IRS approved vault or depository. Your metals will be secured there and under the administration of an IRS approved gold custodian.

Ask your Gold IRA company if their recommended Gold Custodian and depository are IRS approved.

Our preferred Gold IRA company specialists can answers any questions you may have regarding security as it applies to how and where your gold is stored . They have a concise Gold IRA Guide available at no cost here…

[sg_popup id=229]

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/tny_au_en_usoz_2.gif)